May 9 2025

May 9 2025

The growth of iGaming in the Americas shows two different paths. In North America, especially in the United States, the market has become well-established and generates high revenue. Meanwhile, South America is growing quickly, with Brazil leading the way.

In 2024, North America generated approximately $25 billion in gross gaming revenue (GGR) from online gambling—$22–23 billions of which came from the U.S. alone. In contrast, South America's iGaming market was valued between $1–2 billion, though it boasts the fastest growth rate globally, with a projected CAGR of 13.7% from 2023 to 2028 (Grand View Research).

North America represents 20–25% of global iGaming revenue, trailing only Western Europe (36%). While South America's share is still small, improving regulatory conditions—especially in Brazil—are accelerating its rise.

American iGaming participants are predominantly aged 25–44, digital natives who value mobile-first, fast-paced entertainment. Key preferences include:

According to CasinoRank research, analyzing the US online gambling market, the 35–54 age group represents a significant portion of the growing online casino market, particularly in regions where interest in traditional casino games like blackjack and poker is resurging.

Across all age groups, users prioritize security, smooth payments, and reliability. Motivations range from profit and excitement to social interaction and stress relief.

Estimated market value: $9.69 billion (2024) Brazil dominates the region due to its newly regulated online sports betting and casino sectors. With deep national passion for football, betting activity is especially strong in this vertical.

Estimated market value: $3.80 billion Legal and technological developments have spurred market growth. Argentine players increasingly embrace digital gambling platforms offering diverse game libraries.

Estimated market value: $2.01 billion Colombia was Latin America’s regulatory pioneer, creating a secure and stable iGaming framework. Its success has attracted international operators and made it a regional benchmark.

Estimated market value: $16.56 billion (2024) The U.S. iGaming sector surged following the 2018 repeal of PASPA. By 2024, over 30 states legalized sports betting, and seven supported regulated online casinos. Trends include:

Estimated market value: $4.19 billion The legalization of single-event sports betting in 2021 helped spur structured growth. Ontario led the charge, generating CAD $1.4 billion and over 1 million active accounts in its first year.

Annual turnover: Over $10 billion Despite regulatory uncertainty, Mexico remains a top market, driven by its large player base and cultural affinity for gambling.

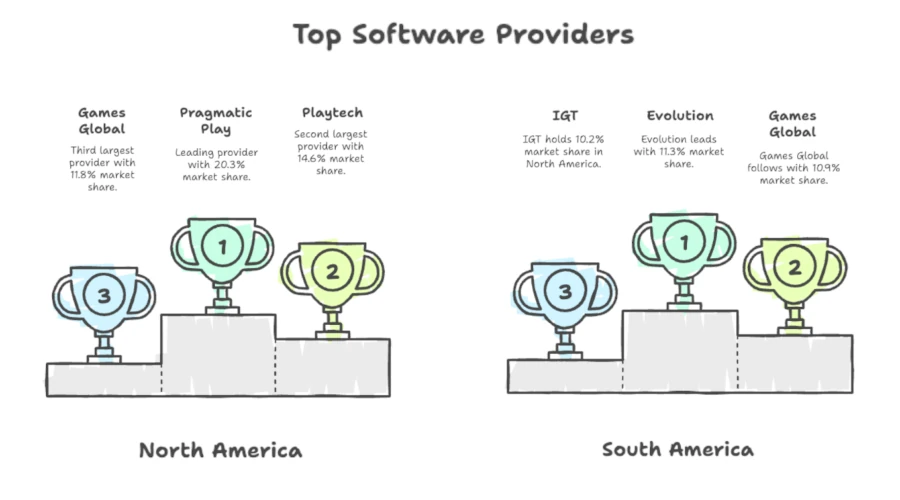

To understand platform popularity, here’s how market share is distributed across leading game developers:

Note: South America is more concentrated among top providers, while North America’s market is more fragmented—with 42.8% going to smaller studios.

| Metric | North America | South America |

|---|---|---|

| Market Size | 73 million users | 8–9 million users |

| Daily Actives | ~3 million | ~1 million |

| Vertical Split | 62% sports / 38% casino | Heavily sports-focused |

| Engagement | Frequent, long sessions | Less frequent, shorter sessions |

| Top Provider Share | Top 9: 59.9% | Top 6: 69.4% |

| Regulation | Advanced & state-led | Evolving, especially Brazil |

North America leads the world in iGaming revenue and infrastructure. However, South America, especially Brazil, is growing quickly and may change the global market. With a focus on mobile and strong growth indicators, South America is set to become a major player in iGaming in the next few years.

As both regions change, it is important for operators, investors, and platforms to understand their differences and take advantage of local opportunities. This will help them succeed in a diverse and dynamic online gambling market.

There is a No Deposit Bonus available: 10000 Gold Coins + 1 Stake Cash

There is a No Deposit Bonus available: 10000 Gold Coins + 1 Stake Cash

Curacao-License

There is a No Deposit Bonus available: 50 Free Spins

There is a No Deposit Bonus available: 50 Free Spins

Curacao-License

There is a No Deposit Bonus available: $60 Free Cash

There is a No Deposit Bonus available: $60 Free Cash

There is a No Deposit Bonus available: $60 Free

There is a No Deposit Bonus available: $60 Free

There is a No Deposit Bonus available: $15 Free Cash

There is a No Deposit Bonus available: $15 Free Cash

Curacao-License

There is a No Deposit Bonus available: $25 Free Chips

There is a No Deposit Bonus available: $25 Free Chips

Curacao-License

Curacao-License

Curacao-License

There is a No Deposit Bonus available: 15 Free Spins

There is a No Deposit Bonus available: 15 Free Spins

There is a No Deposit Bonus available: 50 Free Spins

There is a No Deposit Bonus available: 50 Free Spins

Curacao-License

There is a No Deposit Bonus available:

$31 Free

There is a No Deposit Bonus available:

$31 Free